Bond Yield Calculator Zero Coupon

Looking at the formula 100 would be f 6 would be r and t would be 5 years.

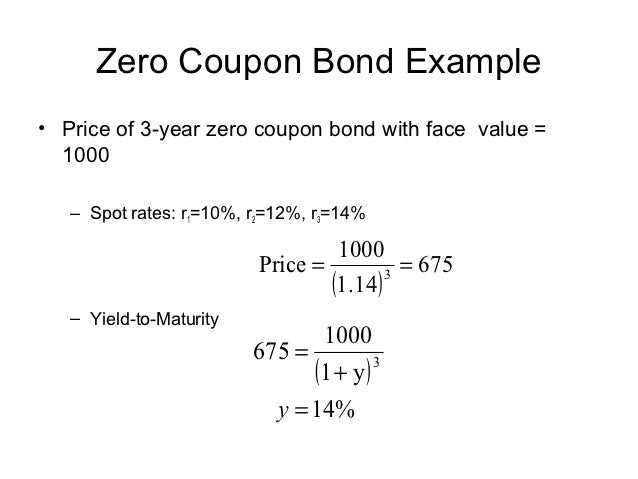

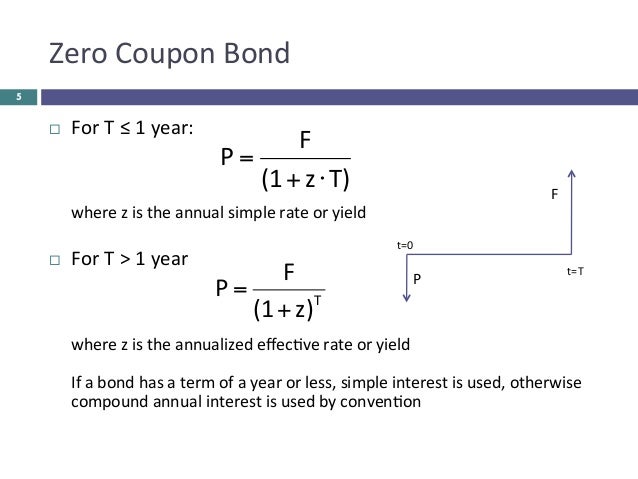

Bond yield calculator zero coupon. It is given by price face value 1 y n where n is the number of periods before the bond matures. Example of zero coupon bond formula with rate changes. This makes calculating the yield to maturity of a zero coupon bond straight forward. This means that you can solve the equation directly instead of using guess and check.

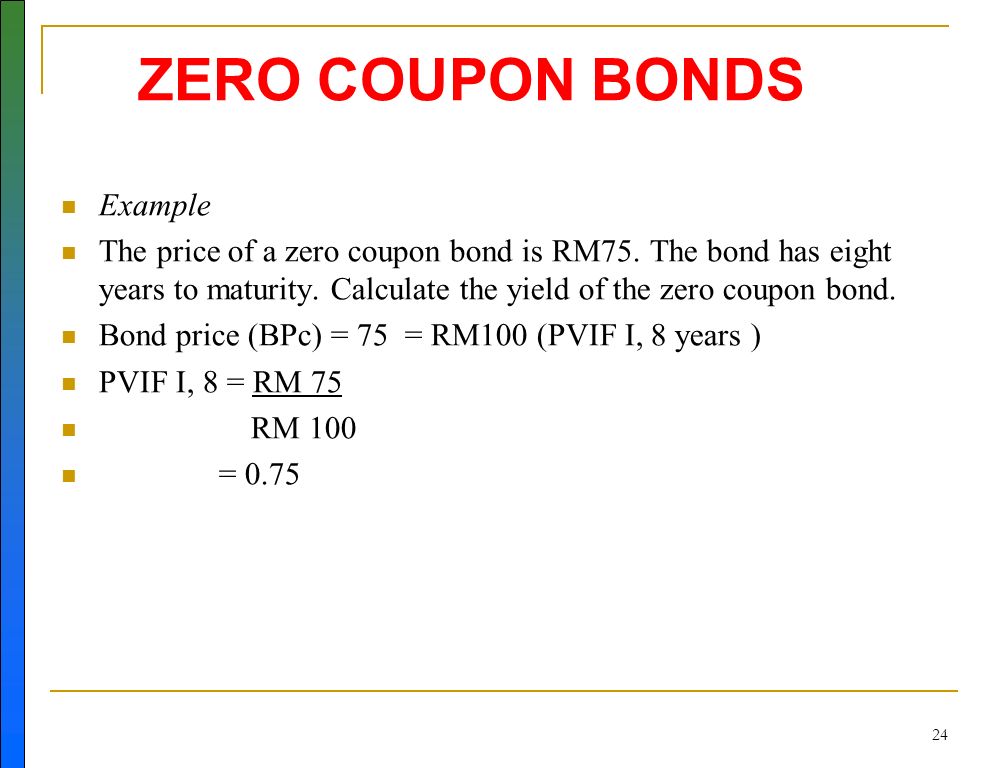

A zero coupon bond is a bond that does not pay dividends coupons per period but instead is sold at a discount from the face value. The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond or sometimes referred to as a discount bond. Zero coupon bond yield calculator a zero coupon bond or a deep discount bond is a bond that does not pay periodic coupon or interest. The formula for calculating the yield to maturity on a zero coupon bond is.

Zero coupon bond definition a zero coupon bond is a bond bought at a price lower than its face value with the face value repaid at the time of maturity. Yield to maturity. Yield to maturity of zero coupon bonds. Of annuity bond yield.

It does not make periodic interest payments. Yield to maturity face value current bond price 1 years to maturity 1 consider a 1 000 zero coupon bond that has two. Bond yield formulas see how finance works for the formulas for bond yield to maturity and current yield. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond.

The zero coupon bond calculator is used to calculate the zero coupon bond value. Example of zero coupon bond formula a 5 year zero coupon bond is issued with a face value of 100 and a rate of 6. A zero coupon bond is a bond which doesn t pay periodic payments instead having only a face value value at maturity and a present value current value. The calculator which assumes semi annual compounding uses the following formula to compute the value of a zero coupon bond.

Instead interest is accrued throughout the bond s term the bond is sold at a discount to par face value. The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. Zero coupon bond calculator zero coupon bonds do not pay interest throughout their term.

:max_bytes(150000):strip_icc()/GettyImages-983195940-6d4c5099c3314718a5ba16c33205d071.jpg)