Child Tax Credit Calculator Usa

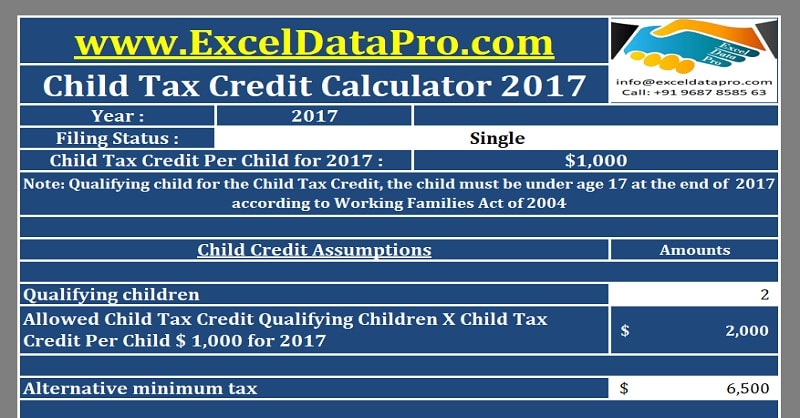

How much is the child tax credit.

Child tax credit calculator usa. More child tax credit requirements and rules. Turbotax online and mobile pricing is based on your tax situation and varies by product. 0 federal for simple tax returns 0 state 0 to file offer only available with turbotax free edition. The child credit is a credit that can reduce your federal tax bill by up to 2 000 for every qualifying child.

Offer may change or end at any time without notice. 2018 2019 2020 additional amount child credit eligibility how much tax as with any tax credit refund or deduction there are a few rules that will influence the amount that eligible applicants will receive. The person s date of birth. You can t carry forward any portion of the child tax credit to future tax years.

The recent tax cuts and jobs act tcja also dramatically increased the income limits so now most families in america with qualifying children will have the chance to claim this credit. Just answer the questions and follow the steps. You can save thousands every single year through claiming the child tax credit. Get an estimate of how much you could get in tax credits during the 2019 to 2020 tax year.

The child must have been 16 or younger on december 31 of the tax year. New laws for tax years 2018 and beyond actually doubled the child tax credit bringing it up to the current 2 000 credit for each qualifying dependent with a refundable amount up to 1 400. A credit directly reduces your tax bill dollar for dollar. This type of dependency credit is highly valued by families.

In most cases a tax credit is better than a tax deduction. To qualify for the child tax credit you must have a child or dependent who meets all of the following requirements. The dependents tax credit calculator will enable you to figure out if you can claim your child as a dependent on your tax return and how much you can get. You need to claim the nonrefundable credits in a certain order to get the most benefit.

The child tax credit is intended to help offset the tremendous costs of raising a child or children. The tax year is from 6 april to 5 april the following year. If it looks like you qualify for tax credits contact hm revenue and customs hmrc to start your claim. If you qualify the credit can be worth up to 2 000 per child for tax year 2018 2025.

Child tax credit tax credits tags. Whether you can claim the person as a dependent. The child tax credit phase out is also more generous beginning at 200 000 for singles and reaching up to 400 000 for joint filers. Try for free pay when you file.

This interview will help you determine if a person qualifies you for the child tax credit or starting in 2018 the credit for other dependents.